The best renters insurance companies

Table of Contents

Table of Contents

As a renter in Colorado, you may be wondering if renters insurance is really necessary. After all, you don’t own the property you’re living in, so do you really need to insure it? The short answer is yes. Renters insurance can provide valuable protection and peace of mind in the event of unexpected events. In this article, we’ll explain renters insurance quotes Colorado, and why it’s important for renters to have adequate coverage.

Pain Points of Renters Insurance Quotes Colorado

As a renter, you may have several concerns about purchasing renters insurance. You may be worried about the cost, or whether the coverage is really necessary. You may also be unsure of what exactly renters insurance covers, and how much coverage you really need. These are all valid concerns, and we’ll address them throughout this article.

What is the Target of Renters Insurance Quotes Colorado?

The target of renters insurance quotes in Colorado is to help renters protect their belongings and personal liability. Renters insurance can cover the cost of replacing or repairing personal property that is damaged or lost due to covered perils such as fire, theft, or water damage. It can also provide liability coverage if someone is injured on your rental property and sues you for damages.

Main Points About Renters Insurance Quotes Colorado

Renters insurance quotes Colorado provides protection for renters’ personal property and liability. It can cover a wide range of perils, including fire, theft, and water damage. Renters should choose a policy with coverage limits that meet their needs and budget. Many policies also offer additional optional coverages, such as earthquake or flood insurance, that may be necessary depending on the location of the rental property. It’s important to shop around and compare quotes from multiple insurers to get the best coverage at the lowest price.

Personal Experience with Renters Insurance Quotes Colorado

When I first moved into my apartment in Colorado, I was hesitant to purchase renters insurance. I thought it was an unnecessary expense, and I didn’t think anything bad would happen. However, after a neighbor’s apartment was damaged in a fire and they lost all of their belongings, I realized how important it was to have coverage. I ended up purchasing a policy with adequate coverage limits, and it has brought me peace of mind knowing that my belongings are protected.

Why You Need Renters Insurance Quotes Colorado

Renters insurance provides valuable protection for both your personal belongings and your personal liability. If your rental property is broken into or suffers damage due to a covered peril, you could be facing significant costs to replace or repair your belongings. Additionally, if someone is injured on your property and sues you for damages, renters insurance can provide liability coverage to help cover legal fees and court-ordered damages.

Additional Information About Renters Insurance Quotes Colorado

In addition to basic coverage for personal property and liability, renters insurance policies may offer additional optional coverages such as earthquake or flood insurance. These coverages may be necessary depending on the location of the rental property and the common perils in the area. It’s important to review your policy carefully and ensure that you have adequate coverage for all potential risks.

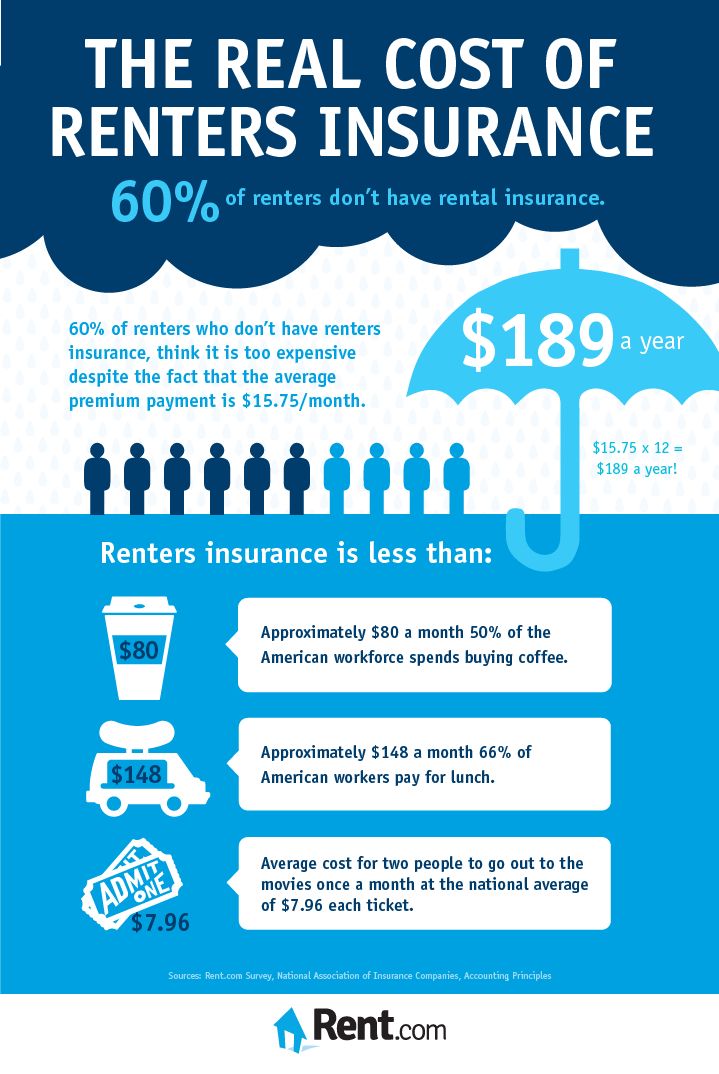

The Cost of Renters Insurance Quotes Colorado

The cost of renters insurance in Colorado can vary depending on several factors, including the level of coverage you choose, your deductible, and the location and value of your personal property. However, renters insurance is generally very affordable, with many policies averaging less than $20 per month.

Question and Answer

Q: Is renters insurance required by law in Colorado?

A: Renters insurance is not required by law in Colorado, but some landlords may require tenants to have it as part of their lease agreement.

Q: How much renters insurance coverage do I need?

A: The amount of coverage you need depends on the value of your personal property and your personal liability risks. It’s important to carefully review your policy and ensure that you have adequate coverage for all potential risks.

Q: Will renters insurance cover damage caused by my own negligence?

A: Renters insurance typically does not cover damage caused by the policyholder’s own negligence. However, liability coverage can provide protection if you are sued for damages by someone else who was injured on your property.

Q: Can I bundle renters insurance with other insurance policies?

A: Many insurance companies offer discounts for bundling multiple policies, such as renters insurance and auto insurance.

Conclusion of Renters Insurance Quotes Colorado

As a renter in Colorado, renters insurance quotes are an important consideration to protect your personal property and liability. By understanding the coverage options available, you can choose a policy that meets your needs and budget. Don’t wait until it’s too late - purchase renters insurance today to ensure that you’re protected in the event of unexpected events.

Gallery

Renter’s Insurance In NYC - Do You Need It? - Platinum Properties

Photo Credit by: bing.com / insurance renters renter

The Best Renters Insurance Companies - Reviews.com

Photo Credit by: bing.com / insurance renters definition quotes advantages having reviews pros cons companies low down why need iii courtesy compare ultimate guide

Your Renters Insurance Guide | III

Photo Credit by: bing.com / renters renter homeowners

The Best Cheap Renters Insurance In Colorado - ValuePenguin

Photo Credit by: bing.com / renters insurance

Do I Need Renters Insurance? - Compass Insurance Agency

Photo Credit by: bing.com / renters renter placer compass less casualty license renting assistance